Make certain to compare rate of interest, fees, and other regards to the home mortgage. Additionally, home mortgage rates are constantly changing, so getting rate quotes from several lenders in a short time duration makes it much easier to obtain a precise contrast. If that's way too much research, you could deal with a home loan broker. They service compensation, which is usually paid by the lender. FHA financings call for two kinds of home mortgage insurance to shield loan providers against default.

- Property buyers might just get funding for 50% to 60% of the home's value, which meant they needed to look for numerous mortgages to fund their house.

- This yearly modification enables you to wait for the perfect time to get an FHA mortgage, yet finance limits are driven by the average sales price of that location.

- A fixed-rate funding of $250,000 for 15 years at 2.000% rate of interest as well as 2.248% APR will have a regular monthly settlement of $1,608.

- With a reverse home loan, you can utilize your home equity to supplement your retired life funds.

The solution used by a lot http://lanelrdj509.iamarrows.com/contrast-todays-mortgage-and-re-finance-rates of loan providers is a home loan rate lock. MI will be required for all FHA and also VA finances as well as traditional loans where the loan-to-value is above 80%. Nonetheless, the expense of an FHA mortgage consists of greater than simply your rates of interest as lots of loan providers charge fees for their solutions. The rates shown over are the current rates for the acquisition of a single-family primary home based on a 60-day lock period.

Various Other Fundings

FHA rates differ per lender, and also each lending institution Go to this website can include their own costs into the financing. While source charges are typically around 1%, some lending institutions might need a greater rate Try to negotiate source costs to reduce your mortgage prices. Our overview will discuss a short history of the FHA home loan program, exactly how it works, as well as the certifications to safeguard an FHA car loan.

Fha Finance Benefits And Drawbacks

The FHA program is indicated to promote borrowing among lower and center class consumers. To safeguard home mortgage lenders, they provide federal insurance coverage securities in instance debtors default on their financings. To get the best home loan interest timeshares in europe rate for your situation, it's best to search with numerous lenders. Rates of interest help establish your regular monthly home mortgage repayment along with the overall amount of passion you'll pay over the life of the loan. While it may not look like much, also a fifty percent of a percentage point decrease can amount to a considerable quantity of cash. The very best home mortgage price for you will certainly depend on your monetary circumstance.

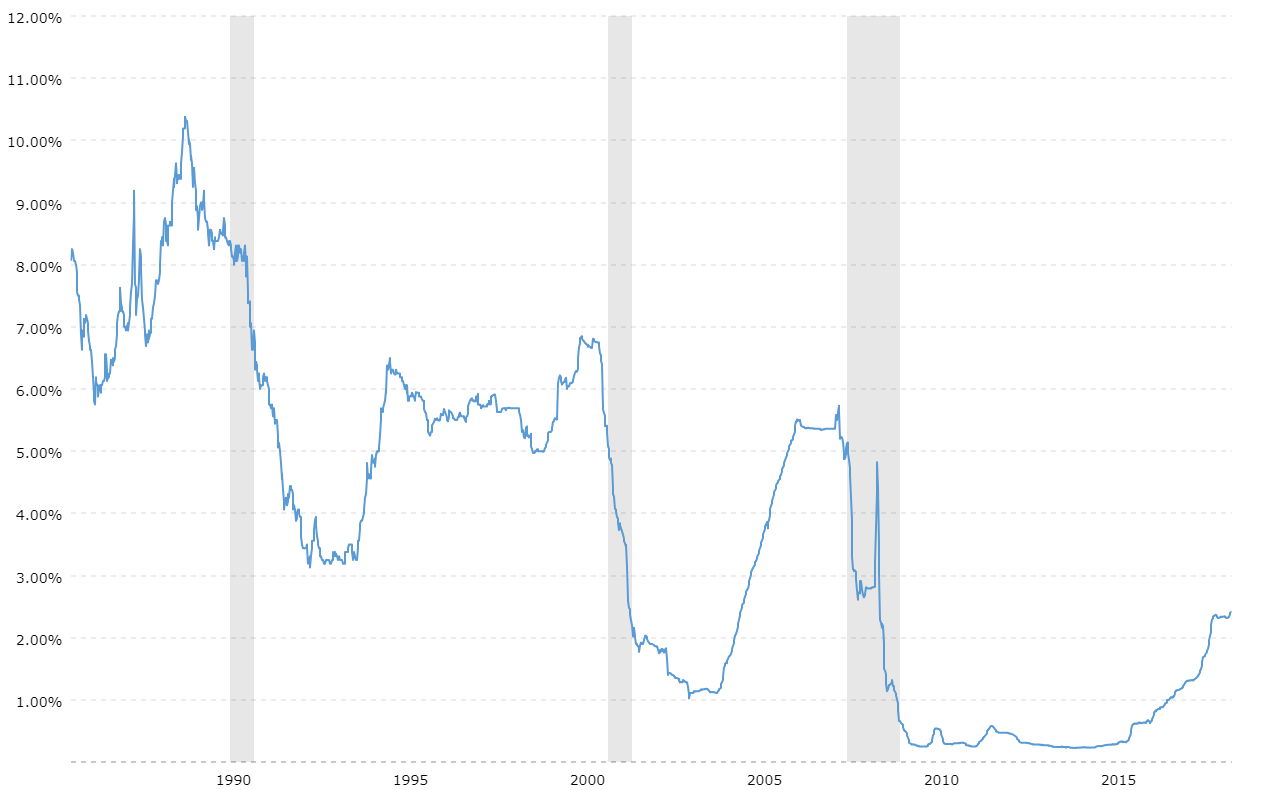

Average Home Loan Rate Of Interest By Year

The ordinary 5/1 variable-rate mortgage price is 2.740% with an APR of 4.070%. The home loan prices below are example prices based upon presumptions. Use our calculator to see approximated rates today for home mortgage and also re-finance financings based on your specific demands. Given that the FHA assures the home mortgage, the financing needs are not quite as stringent as they might be with other funding choices. FHA-insured home loan are extra credit-friendly and call for a reduced deposit.

Credit history scorehas a bigger influence on mortgage prices than financing type. If you have a high credit score, your FHA financing rate will possibly be lower than that of a person with a reduced credit report. Freddie Mac's regular record covers home mortgage prices from the previous week, however rates of interest transform daily-- home loan rates today might be different than reported.

Everything depends upon your loan provider as well as what's going on in the marketplace. The only essential requirement of a VA lending is that you need to be a qualified active-duty servicemember, reservist, veteran or qualified surviving spouse. You might have the ability to manage a much more pricey home if you select a 30-year term. When your loan provider assesses your finance, they'll think about how your new home loan settlement fits in with your debt-to-income proportion.